Big firms have different incentives

A reason large firms conduct R&D at the same rate as small ones, despite (apparently) lower R&D productivity

This post is a collaboration between me and Arnaud Dyèvre (@ArnaudDyevre), a PhD student at the London School of Economics working on growth and the economic returns to publicly funded R&D. Learn more about my collaboration policy here.

This article will be updated as the state of the academic literature evolves; you can read the latest version here. You can listen to this post above, or via most podcast apps here.

In a previous post, we documented a puzzle: larger firms conduct R&D at the same rate as smaller firms, despite getting fewer (and more incremental) innovations per R&D dollar. Why wouldn’t firms decelerate their research spending as the return on R&D apparently declines? In this follow-up post, we look at one explanation: firms of different sizes face different incentives when it comes to innovation. In a later post, we’ll review another explanation, that large firms have different inventive and commercialization capabilities.1

Cost spreading and invisible innovations

To start, let’s revisit our claim that the return to R&D seems to fall as firms get larger. Is this accurate?

We can think of the returns to R&D as the “results” a firm gets out of R&D, divided by that firm’s R&D “effort.” Typically we measure those “results” by new patents, products, or streams of profit. It turns out some of these measures might understate innovation by large firms, because larger firms are more likely to generate process rather than product innovations. Process innovations are concerned with better ways of delivering a service or manufacturing a product, not creating a new business line.

Process innovations will not show up directly in product based measures of innovation.2 For example, some earlier posts have looked at the introduction of new consumer products or the attributes of car models as measures of the output of innovation. And while process innovations can be patented, they are probably less likely to be patented than new products. For example, a 1994 survey (Cohen, Nelson and Walsh 2000) asked 1500 R&D labs in the manufacturing sector to rank five different ways of capturing the value of new inventions. Among the 33 different sectors to which the firms belonged, just 1/33 thought patents the most effective way to protect process inventions compared to 7/33 who thought them the most effective way to protect a new product invention. In contrast, 16/33 sectors think patents the worst way to protect new process inventions, compared to 10/33 think patents the worst way to protect product inventions. Another way to summarize the survey is to note that only 23% of respondents reported that patents were effective means to appropriate process innovations while 35% considered them effective to appropriate product innovations.

If process innovations are less likely to find their way into the catalogues of new products or the patent portfolio of firms, then they are less likely to be picked up by conventional measures of innovation. If larger firms are disproportionately likely to engage in process innovation, that will make it seem as if larger firms get fewer results from their R&D. And we do have some evidence large firms are more process innovation oriented.

Liu, Sojli, and Tham (2022) use natural language processing to try and classify patents as protecting process or product innovations. The main approach breaks the title of patents and their claims into multiple components, and then looks to see if these strings of words contain words like “process”, “method” or “use” (which indicate a process), or words like “product”, “apparatus” or “tool” (which indicate a product). When they ask patent examiners and an IP management firm to classify a random sample of hundreds of patents classified by their algorithm, they come up with the same answer around 90% of the time. They show that, over 1976-2020, US public firms that have more active process patents than active product patents tend to be larger.

We also have some non-patent evidence, though it’s based on pretty old surveys at this point. Akcigit & Kerr (2018)match Census data on U.S. firms to a comprehensive survey of R&D activities by the NSF (covering 1979-1989) and find a positive correlation between firm size (defined here as log employment) and the share of R&D dedicated to process innovation.

So both the patent and survey-based evidence suggests larger firms do more process innovation than product innovation. And we also have pretty good theoretical reasons to expect this should be the case.

As Matt has written elsewhere, when a particular kind of technology gets more profitable to invent, firms do more R&D on that kind of technology. To the extent the profitability of different kinds of R&D differ as firms scale, it’s not surprising that their R&D choices should differ. For example, larger firms typically have a wider portfolio of products and sell more products in each line, so it therefore makes sense for them to find more efficient ways to produce and deliver these products because they can spread the costs of their process innovation over more products and product lines. If you expect to sell ten thousand cars, it’s worth $10,000 to invent a process that reduces the cost of manufacturing by $1 per car. If you expect to sell a million, you’ll pay $1 million to invent the same technology.

This explanation has been referred to as the cost spreading advantage of larger firms in conducting R&D: the bigger the firm, the greater the level of output over which it can apply its process R&D. Cost spreading pushes bigger firms toward process innovation. So one reason we may observe fewer innovations per dollar among large firms is that their size incentivizes them to focus on harder-to-observe process improvements.

More speculatively, it might be that a similar dynamic also affects our measurement of the inputs to R&D that further biases our measures of the R&D productivity of firms. It has long3 been suggested smaller firms might underreport R&D expenditures, which would tend to inflate their measured R&D productivity (because they would seem to get more from less). One reason for that might be that, if firms can receive tax breaks for R&D expenditure, larger firms may invest more in sophisticated ways of claiming these breaks, either via more careful documentation or by pushing the boundary of what can be claimed as an expense. It’s kind of a cousin to cost-spreading; if there is a fixed cost of aggressively reporting R&D spending (for example, because you have to hire more tax lawyers), that cost might be more worth enduring for larger firms with more plausible R&D expenses. Boeing & Peters (2021), for example, provide evidence that R&D subsidies are often used for non-research purposes in China. And this isn’t the only possible reason small firms might under-report R&D. Roper (1999) suggests it could also be because it’s harder to measure R&D spending in smaller firms that don’t have full time research staff or dedicated research labs (and so it’s harder to tell what’s R&D and what’s not). That said, while it seems plausible, we’re not aware of evidence that documents biased R&D reporting. Indeed, in Boeing and Peters (2021), they actually do not find any statistically significant correlation between the size of firms and their tendency to mis-report R&D.

The Replacement Effect

The cost spreading incentive pushes large firms toward process innovation, which might be harder to observe but should still be considered a form of genuine innovation. Another incentive pushes them away from product innovation though: the replacement effect.

If a better version of a product is invented, most people will buy the improved version rather than the older one. If you are an incumbent firm that was previously selling that older version, that’s a reason to be less excited about a new product: if you invent a new product, you are partially competing against yourself. If you’re an entrant though, you won’t care. Since incumbents will tend to be larger firms, this dynamic might also explain differences in how firms innovate as they grow larger.

This is an old argument in economics, dating back to Kenneth Arrow (1962), which was later named the ‘replacement effect.’4 Incumbent firms’ reluctance to do R&D in domains that could threaten their core business is closely related to what is sometimes called the innovator’s dilemma in the business literature and is a core tenet of some endogenous growth models.5 The recent development of chatbots powered by large language models offers a possible illustration of this dynamic. Google seems to have underinvested in the type of AI technology powering OpenAI’s ChatGPT because it would be a direct siphon of the ads revenues generated by its own search engine. As a result, Google is finding itself having to make up for lost ground in the AI race it once dominated.

Documenting the extent of the replacement effect at large is a bit tricky because you are looking for R&D that doesn’t happen. One way we could do this is if we came up with a bunch of good ideas for R&D projects and randomly gave the ideas to large and small firms. We could then see which firms ran with the ideas and which ones left them alone. The trouble is, it’s hard enough for firms to come up with good ideas for themselves, let alone innovation researchers to come up with good ideas for them. But there are two studies that are related to this thought experiment.

Cunningham, Ederer, and Ma (2021), while not about innovation and the size of firms specifically, provides some excellent documentation of replacement effect style dynamics. Their context is the pharmaceutical sector, where it is quite common for large incumbent firms to source new R&D projects from small startups. The sector is also one where there is high quality data available on the different research projects (here, new drug compounds) that firms are working on. Cunningham, Ederer, and Ma’s main analysis focuses on comparing what happens to acquisitions where the acquired research project overlaps with something in the incumbent’s existing drug portfolio, as compared to when incumbents acquire research projects for drugs that don’t overlap with their existing portfolio. They find acquired drugs that overlap with the acquirer’s existing portfolio are more likely to see further development instantly abandoned. That’s consistent with firms failing to invest as much in new R&D that competes with their existing product lines.

Technically, this isn’t a replacement effect, because the acquiring firms didn’t merely fail to invest in competitors to their own drugs; they proactively went out and bought competitors, only to kill them! Cunningham, Edererer and Ma show that this can make sense in some situations: not only will a firm not want to spend R&D on a new project that competes with its own projects, but will actually find it profitable to spend money in order to stop other firms from doing R&D on competing projects.

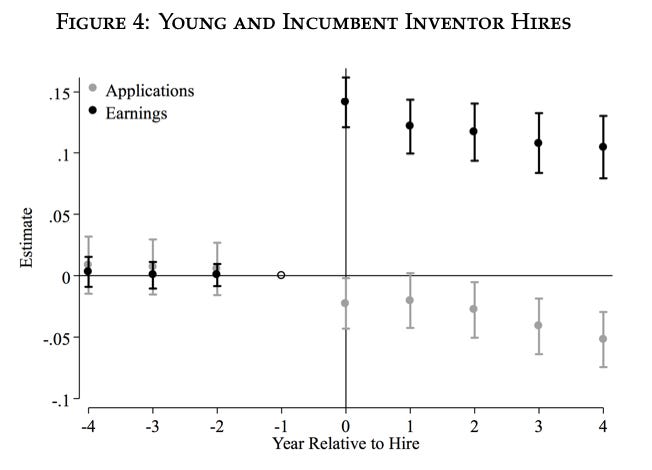

The second study looks not at how firms choose to develop or abandon research projects, but rather how they choose to use identical (at least on paper) research staff. Using a spectacular dataset of patents matched to their inventors’ earnings, Akcigit and Goldschlag (2023) studies the evolution of an inventor’s innovative output—patent applications—around the time when the inventor’s move from a small, young firm to a large, incumbent one. They also study how an inventor’s income change around the switch, thanks to the administrative data they have access to. Their definition of a young firm is one that has been in business for 5 years or less, and their definition of an incumbent firm is one that is more than 21 years old with more than 1,000 employees (their definitions are therefore conflating firm age and size, but we think the results are still relevant).

To evaluate the causal impact of a hire by an incumbent on an inventors’ innovations and earnings, they match inventors who move to incumbents to inventors who move to young firms. These statistical twins are of similar age, income, patenting history and industrial sector (all measured before the hiring event), so that the only observable factor differentiating them is the type of firm they move to.6 While these pairs of inventors have similar innovative output prior to their job changes, Akcigit and Goldschlag show that the average inventor hired by an incumbent starts to innovate less (-6%) compared to their matched peer hired by a young firm. But, matching the stylized fact that larger firms get less output per R&D dollar, Akcigit and Goldschlag find inventors moving to large firms experiences a large increase in earnings (+13%) compared to their matched peer hired by a young firm. As shown in the figure below, the gap in patent applications and earnings between inventors who go to incumbents and entrants are indistinguishable before the job change, and then begin to diverge after they start working in different types of firms.

One interpretation of this is that two equally productive inventors, one working for a young/small firm and another working for an incumbent/large firm, will be told to work on problems that are different. The inventor in the large firm might be asked to work on innovations that are less likely to threaten the firm’s existing product lines, and therefore less likely to lead to patents (let alone high-impact patents). Note also Akcigit and Goldschlag (2023) is consistent with the puzzle we noted at the outset of this post: large firms spend as much on R&D as small firms, but their innovative output per R&D effort is lower. At least when innovative output is measured by patents, Akcigit and Goldschlag suggest that’s because large firms are paying their inventors better but asking them to work on projects less likely to lead to new patents and products.

But Wait, There’s More

To summarize, we’ve seen we have theoretical reasons to expect larger firms to be more attracted to process innovation as well as some empirical evidence that this is so (and that process innovations might be harder to see). We’ve also got some theoretical and empirical evidence that larger firms may be less excited about some kinds of product innovation. Those differences can help explain why bigger firms keep up the R&D pace, even as they appear to be worse at doing R&D. Maybe they aren’t actually worse at R&D! They just do less innovation we can see, and more that we can’t.

Maybe. But that’s not the only story researchers have explored. In a future post we’ll look at some evidence that the relative infrequency of high impact innovations at large firms is not only about incentives and rational choices, but also about the different inventive and commercialization capabilities of larger firms.

Thanks for reading! As always, if you want to chat about this post or innovation in generally, let’s grab a virtual coffee. Send me an email at matt.clancy@openphilanthropy.org and we’ll put something in the calendar.

The question of what drives differences in the nature of innovation between small and large firms has spurred a large literature in economics and beyond. This post only covers a subset of explanations. The interested reader can find a more comprehensive review of the economics literature about this topic in Cohen (2010), part 2.1. This post draws on this review and discuss recent papers illustrating its core arguments about firm incentives.

They can indirectly show up, when new processes allow the creation of new products.

See for example Griliches (1990), which is a survey of the uses of patent data but briefly discusses this issue too.

Jean Tirole seems to have first coined the term ‘replacement effect’ in his 1988 Industrial Organization textbook. See the paper here making this claim.

See for example, Klette & Kortum’s (2004).

Though there are probably other differences we can’t observe; you’ll want to discount the results depending on how important you think those factors may be.